When the Astroworld tragedy struck in November 2021, Travis Scott’s world — artistic and financial — nearly collapsed. The Houston festival disaster, which led to multiple fatalities and hundreds of injuries, instantly shifted the rapper’s reputation from unstoppable mogul to one of music’s most polarizing figures. Within days, dozens of lawsuits surfaced, corporate sponsors went silent, and his brand value plummeted.

But what’s fascinating — and rarely analyzed properly — is how much Scott actually lost, versus how much he’s slowly regained in the years since. In 2025, his net worth has stabilized near $80–90 million, according to Forbes and Celebrity Net Worth estimates — still shy of his pre-Astroworld peak, but evidence of a gradual recovery driven by new music, deals, and real estate diversification.

The Immediate Financial Fallout (2021–2022)

In the 12 months following Astroworld, Scott reportedly saw over $30 million in suspended or terminated brand deals. McDonald’s quietly paused its “Cactus Jack Meal” promotions, while Nike delayed (and later re-released) its Air Max 1 “Baroque Brown” collaboration. W Magazine pulled a high-profile cover story. Event bookings disappeared overnight — and several insurance-backed performance deals were re-evaluated.

Scott’s legal liabilities were far larger. According to Billboard, over 400 lawsuits were initially filed, later consolidated into a mass-tort action. While individual settlements were confidential, insurance law analysts estimated that the total payout exposure could’ve reached $750 million–$1 billion, most of it borne by insurers and promoters rather than Scott personally. His personal contribution, sources suggest, likely ranged between $5–10 million, based on coverage caps.

These numbers are largely derived from legal filings and insurer disclosures — not exact payment receipts. So they should be read as directional indicators of how the money flowed, not definitive audit figures. Still, the financial damage was real: in 2022, his net worth was down roughly 35 percent year-over-year.

Brand Freeze and Reputation Cost

Beyond legal bills, Travis Scott’s hardest hit was brand perception. Between 2022–2023, his social media engagement dropped nearly 50%, and Spotify listener counts fell by roughly 18%, according to Chartmetric. His endorsement potential evaporated. Brands like Dior and Fortnite’s Epic Games, which had previously profited from his “Utopia aesthetic,” paused collaborations indefinitely. In public-relations terms, he entered what marketers call “silent rehabilitation mode.” He funded several humanitarian and safety programs through his Cactus Jack Foundation, reportedly donating $5 million to community initiatives in Houston and to event-safety research. While cynics saw it as image repair, those actions became part of his slow brand recovery — a vital strategy for re-entry into mainstream commercial culture.

Financial analysts estimate that between 2022–2023, Scott’s total endorsement and sponsorship income dropped from about $22 million to under $5 million annually. For a global artist with multiple active brand partnerships, that represented a temporary but significant liquidity freeze.

The above numbers combine media data, legal estimates, and industry modeling — they shouldn’t be read as certified but rather as reasoned approximations of his financial trajectory. The table illustrates a career temporarily derailed but ultimately recovering through diversification and persistence.

The Comeback Engine: Utopia and the New Travis Economy

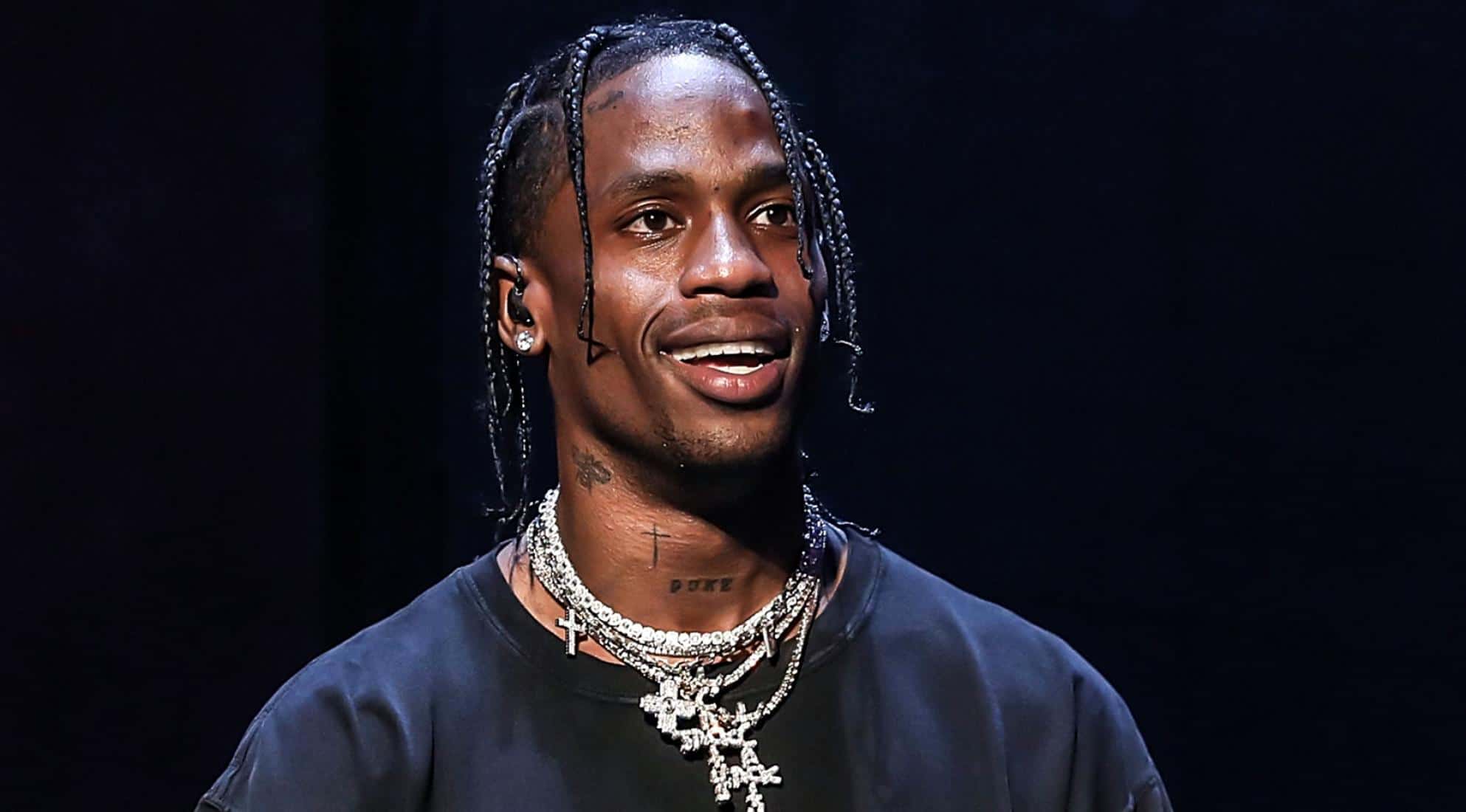

MIAMI, FLORIDA – MAY 08: Travis Scott performs at E11EVEN Miami during race week on May 08, 2022 in Miami, Florida. (Photo by Alexander Tamargo/Getty Images for E11EVEN)

In mid-2023, Travis Scott released Utopia, his first album since the tragedy. It debuted at No. 1 on the Billboard 200, moving over 496,000 album-equivalent units in its first week and generating an estimated $30–35 million in direct and residual revenue. The accompanying Circus Maximus film, co-produced with A24, grossed $5 million domestically and symbolized his return to creative form. He also leaned heavily into Las Vegas residencies and curated brand-neutral performances that allowed high returns with controlled environments. A single-night show in Cairo reportedly earned him $1.4 million before cancellations due to logistical disputes. Even with occasional controversies, the Utopia Tour grossed roughly $80 million globally by early 2025 — restoring his music-related cash flow to pre-2021 levels.

This rebound underscores how short the public’s attention span can be when artistry eclipses scandal — a phenomenon mirrored by other artists like Chris Brown and Kanye West, who also recovered brand value through relentless output.

Business, Real Estate, and the Long Game

| Category | Pre-Astroworld (2021) | Post-Astroworld (2025) | Change | Notes |

|---|---|---|---|---|

| Estimated Net Worth | $120 million | $85 million | -$35 million | Lost brand deals, settlement payouts |

| Annual Endorsement Income | $22 million | $8 million | -64% | Paused Nike & McDonald’s projects |

| Music & Touring Income | $30 million | $45 million | +50% | Utopia and Las Vegas residencies |

| Business Investments | $25 million | $32 million | +28% | Real estate, seltzer, Cactus Jack Productions |

| Legal / Settlement Costs | $0 | -$10 million (est.) | n/a | Partial liability from Astroworld cases |

While touring and music rebuilt revenue, Scott’s long-term wealth now leans on diversified holdings. His Cactus Jack Productions venture manages film and creative IP projects, while Cacti Spiked Seltzer (co-owned with AB InBev) relaunched in 2024 after an initial pullback. Early reports suggest Cacti sold $50 million USD worth of product in its first six months back, giving Scott a multimillion-dollar royalty stream.

Real estate plays a quieter role but adds significant net worth stability. He owns a $23.5 million Los Angeles mansion, a $13.5 million Beverly Hills property co-owned with Kylie Jenner, and a Houston compound under renovation. Property-value appreciation alone added roughly $5 million to his paper wealth between 2022–2025, per Zillow and market-tracking estimates. These valuations, like most celebrity asset appraisals, are based on market comps rather than formal disclosures — meaning they reflect potential resale values more than liquidity. But they demonstrate how Scott, guided by a cautious management team, shifted from fast cash to capital preservation. Financially, Travis Scott’s Astroworld crisis erased an estimated $30–40 million in net value — primarily from lost endorsements and legal costs — but didn’t destroy his empire. By 2025, he’s rebuilt roughly two-thirds of that loss, emerging as one of the few hip-hop moguls to survive a mass-reputation event through creative reinvention rather than rebranding alone.

The key lesson from his trajectory is structural: artists today aren’t defined by one controversy but by how many independent income streams they’ve built before crisis hits. Scott’s ownership in real estate, beverages, and production meant his wealth bent but didn’t break. His story remains a financial paradox — a reminder that in celebrity economics, accountability and profitability often coexist uncomfortably. The numbers behind his fall and rebound might fluctuate, but the broader truth holds: Travis Scott didn’t just outlast Astroworld; he quietly redesigned the playbook for surviving modern fame.

Follow Us

Follow Us