When Disney acquired Lucasfilm in late 2012, it secured rights to two high-grossing media franchises — Indiana Jones and Star Wars. Built around exciting galactic tales, the Star Wars franchise has quite a long and storied history leading up to its emergence as Lucasfilm’s biggest asset and of course one of the highest-grossing media franchises in history. It all began in 1971 when George Lucas founded the company to facilitate the creative liberty he needed for his projects after debuting with THX 1138 (1971).

While 1973’s American Graffiti was Lucasfilm’s first production, 1977’s Star Wars marked the birth of its greatest intellectual property, the beginning of a franchise that quickly became a global phenomenon. Beyond films and television series, the brand has expanded to include novels, comic books, video games, and theme park attractions. Star Wars’ evergreen cultural impact and market base are the bedrock of its profitability and long-term value in the entertainment industry. Those are the factors that inspired Disney’s acquisition of Lucasfilm.

Disney Acquired Lucasfilm For Over $4 Billion In December 2012

The Walt Disney Company added Star Wars to its portfolio of intellectual properties when it acquired Lucasfilm on December 21, 2012. After months of speculations regarding the deal, Disney confirmed it would acquire Lucasfilm Ltd. in a stock and cash transaction. A press statement the company released on October 30, 2012, divulged that the transaction value was $4.5 billion, half of which will be paid in cash, and the rest with approximately 40 million shares.

On December 21, 2012, Disney completed the acquisition, securing rights to the company’s creative and tangible assets. These include its film franchises, post-production businesses, subsidiary companies, and entertainment technologies. However, Jay Rasulo — Disney’s Senior Executive VP and CFO — revealed that the Star Wars franchise was the major motivation behind the acquisition of Lucasfilm. “Our valuation focused almost entirely on the financial potential of the Star Wars franchise,” he said. “We expect (it) to provide us with a stream of storytelling opportunities for years to come.”

As culled from the US Securities and Exchange Commission’s quarterly report, Disney paid $2.2 billion in cash alongside 37.1 million shares to take over Lucasfilm. The report issued on March 30, 2013, specified that each Disney share was worth $50.00 on the day the deal was completed. This means the value of the shares exchanged was $1.855 billion, bringing the total value of the transaction to $4.055 billion. As of June 11, 2024, the Walt Disney share was trading at $102.54. As such, the worth of the shares Lucas received is now pegged at over $3.8 billion.

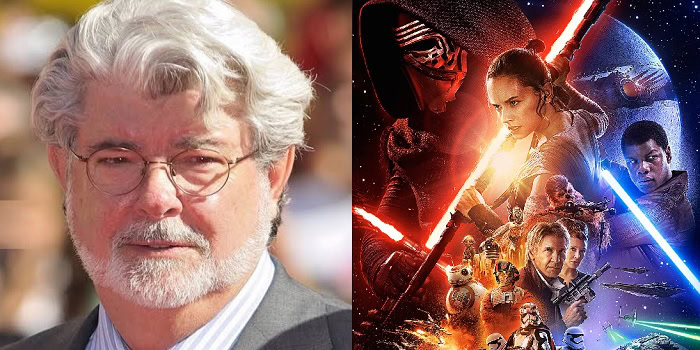

Why Did George Lucas Sell The Franchise?

Any franchise of Star Wars caliber is worth holding on to. This explains the surprise over George Lucas’ decision to part with the franchise. The American filmmaker believes Star Wars needed to evolve and forge new paths that further its legacy. According to Lucas, Star Wars’ intergenerational relevance has been one of his greatest pleasures and he wants the trend to continue. He also asserted it was time to pass the franchise to a new generation of filmmakers.

“I’ve always believed that Star Wars could live beyond me, and I thought it was important to set up the transition during my lifetime,” explained the filmmaker. “Having a new home within the Disney organization, Star Wars will certainly live on and flourish for many generations to come,” he added. From all he said, Lucas’ priority in the acquisition is to preserve the legacy of his groundbreaking brainchild. While Disney’s goals are aligned with Lucas’ expectations, fans were concerned the company would prioritize maximizing profit at the expense of the franchise.

Has Disney Recovered The Money Invested In Star Wars?

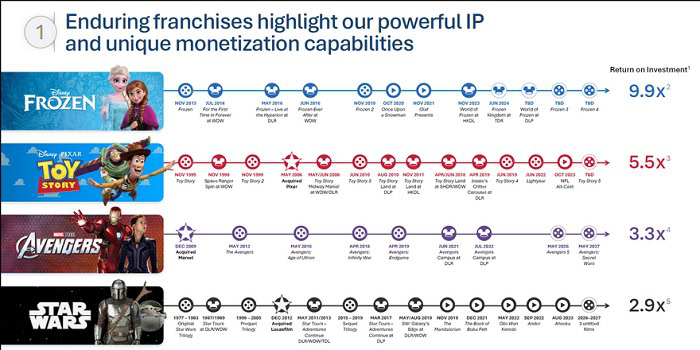

Disney’s purchase of the Star Wars franchise proves to be a profitable investment. Since the acquisition of Lucasfilm, Disney has made several Star Wars films, beginning with 2015’s Star Wars: The Force Awakens. The highest-grossing movie of the year, it made $2.07 billion at the box office against a production budget of $447 million. Star Wars: The Last Jedi and Star Wars: The Rise of Skywalker followed in 2017 and 2019, respectively. While the former grossed $1.334 billion against its budget of $300 million, The Rise of Skywalker made $1.077 billion against $416 million.

Apart from films in the Star Wars sequel trilogy, two standalone films were released in 2016 (Rogue One: A Star Wars Story) and 2018 (Solo: A Star Wars Story). Rogue One grossed $1.058 billion to become the second-highest-grossing film of 2016, unlike Solo which became the first Star Wars film to bomb at the box office. Above all, recent data from Disney suggests it has made close to $12 billion from Star Wars since it acquired Lucasfilm. In a section highlighting the monetization capabilities of its intellectual property, the company projects a 2.9 return on its investment in Star Wars. Here’s your guide to watching the Star Wars animated series in chronological order.

Follow Us

Follow Us