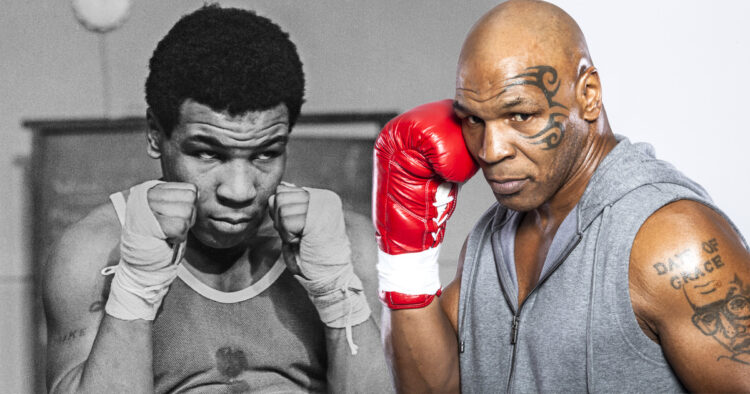

When Jake Paul stepped into the ring against Mike Tyson in July 2025, it wasn’t just a boxing match — it was a generational collision designed to mint money. The 29-year-old YouTuber-turned-fighter and the 58-year-old heavyweight legend entered Netflix’s first ever live-sports pay-per-view, and the numbers proved staggering.

According to Bloomberg and The Athletic, the fight drew 86 million live streams worldwide and set a new internal Netflix record for same-day sign-ups. Advertising partnerships with DraftKings, PRIME Hydration, and Adidas pushed total event revenue to nearly $180 million.

But the question everyone’s asking is simple: who actually got richer?

Let’s follow the money from streaming rights to post-fight net-worth surges.

The Biggest Paydays in Streaming History

Financial disclosures and insider reports suggest Paul secured a guaranteed purse of $30 million, but his deal with Netflix extended far beyond the ring. As co-producer through Most Valuable Promotions (MVP), Paul received an additional 25 percent backend share, translating to roughly $40 million in profit participation once the event crossed its viewership threshold. Combined with merchandising and brand integrations, his total fight-day income likely exceeded $75 million.

Mike Tyson’s deal was structured differently — lower upfront, higher legacy upside. His $15 million base purse was paired with a multi-year image rights agreement worth about $5 million annually for five years. This guaranteed him long-term royalties tied to the fight’s footage, documentaries, and branded media. For a 58-year-old fighter long past his prime, Tyson turned nostalgia into compounding income.

The Sponsorship and Branding Explosion

The sponsorship ecosystem surrounding the fight was nearly as lucrative as the fight itself. Paul leveraged his influence-driven empire to secure brand dominance across every camera angle. PRIME Hydration, the energy drink co-founded by his brother Logan Paul and KSI, featured prominently throughout the event and gained $12 million in advertising exposure value. Additionally, his YouTube channel and post-fight content generated an extra $4 million in ad revenue within a week.

Tyson capitalized through his business ventures — most notably Tyson 2.0, his cannabis brand, and CopperGel, his wellness line. Within three days of the fight, e-commerce platforms reported a 40 percent surge in Tyson 2.0 sales, generating around $5 million in new revenue. The former champion’s face was suddenly everywhere again — this time, not on a poster, but on product packaging sold worldwide.

| Fighter | Guaranteed Purse | Backend & Sponsorship Earnings | Total Estimated Fight Income | 2025 Net Worth After Fight | Percent Net-Worth Growth |

|---|---|---|---|---|---|

| Jake Paul | $30 million | $45 million | $75 million | $140 million → $215 million | +53 % |

| Mike Tyson | $15 million | $20 million | $35 million | $12 million → $47 million | +291 % |

The Aftermath: How Both Empires Expanded

Netflix reported 2.1 million new paid subscribers that weekend, retaining more than 80 percent of them a month later — proof that combat sports can fuel streaming economics. Paul’s production house Most Valuable Promotions signed a multi-event extension with Netflix, rumored at $300 million over three years. PRIME Hydration also experienced its biggest sales week in history, pushing its valuation past $1.7 billion.

Tyson’s empire saw a renaissance of its own. Tyson 2.0’s market valuation jumped from $250 million to $310 million, attracting investor interest from both Canada and Germany. His name reappeared across podcasts, documentaries, and even NFTs, showing how legacy can reenter relevance with the right partner. In essence, both men walked away richer — but also more future-proof.

The New Blueprint for Celebrity Wealth

NEW YORK, NEW YORK – MAY 13: (L-R) Mike Tyson and Jake Paul speak onstage at the press conference in promotion for the upcoming Jake Paul vs. Mike Tyson boxing match at The Apollo Theater on May 13, 2024 in New York City. (Photo by Sarah Stier/Getty Images for Netflix)

The Jake Paul vs. Mike Tyson fight didn’t just generate paychecks; it outlined a new business formula for fame in the digital era. Instead of fighting for promoters, Paul became one. Instead of cashing out, Tyson cashed in on nostalgia. The result? A shared template where attention equals currency and ownership determines who keeps it.

Their model now guides influencers, athletes, and streamers worldwide. Future fights will be negotiated not by boxing commissions but by data analysts and rights holders, ensuring creators get paid for every viewer, replay, and meme. The richest prizefighters of the next decade won’t necessarily throw the hardest punches — they’ll own the content that throws them.

Follow Us

Follow Us