A dream wedding can often cost a pretty penny. According to Fidelity, the average wedding in America in 2024 cost around $33,000. In 2025, since wedding season is in full swing currently, it’s expected to be around $36,000, Zola reports.

This bride was planning a wedding that was a bit more expensive – $60k. How was she going to pay for it? By borrowing $15k from her sister’s inheritance, of course! However, it turned out to be hard to persuade the sister, since she wasn’t keen on the idea of lending $15k for a party. To find out if she’s being too rigid, the sister turned to the Internet and asked people for their unbiased opinions.

A woman was asked to fund her sister’s wedding by adding $15k from her inheritance

Image credits: Prostock-studio (not the actual photo)

When she refused, the sister went to extended family members and complained that she was getting robbed of her dream wedding

Image credits: Rawpixel (not the actual photo)

Image credits: SmilesNSarcasmm

More than half of U.S. newlyweds go into debt for their wedding

It might seem trivial to some, but people are generally prepared to invest pretty big sums of money into their wedding day. In 2024, the American wedding industry was valued at $64.93 billion, and it was projected to grow by 6.8% by 2030.

Probably few people have the luxury of planning a wedding for $60k, but many still go way above their pay grade. According to LendingTree, 67% of newlyweds go into debt for their wedding. How do people even pay for their weddings if they don’t have the money for it?

Looking at these numbers alone might make you think that planning an expensive wedding is not worth it. But experts say that we shouldn’t shame people for spending a lot of money on their dream wedding.

Matt Schulz, LendingTree chief consumer finance analyst, says that wedding debt isn’t always a bad thing. “Good debt absolutely exists, and it is debt that comes with a return on investment,” he explained. “I believe that a dream wedding, vacation or some other experience that brings memories that will last a lifetime and strengthen your bonds with your friends and family has a strong return on investment as well.”

Image credits: Jeremy Wong (not the actual photo)

The honeymoon, the venue, and the catering are often the most expensive elements of a wedding

Depending on the couple’s priorities, different elements of a wedding can be the most expensive. Stylish newlyweds might dedicate the biggest portion of the budget to the attire. If it’s a destination wedding, odds are the travel expenses will cost the most.

Yet a few elements almost always tend to be the most expensive across different sources: the venue, the food and drink budget, and the photography and videography services. If the couple decides to go on a honeymoon right after the nuptials, the trip tends to be the most expensive of all.

According to the survey by LendingTree, couples spend an average of $6,260 on their honeymoons. The cost of a wedding venue can differ from couple to couple: Zola reports that it might cost anywhere from $6,500 to $12,000. In the U.K., a wedding venue tends to be more expensive: experts estimate the average to be between $10,000 and $16,000.

Catering is often the third most expensive thing to worry about. LendingTree reports an average of $4,330, and Zola estimates it somewhere between $6,500 and $10,000. The wedding cake alone, according to The Knot, costs an average of $540.

Image credits: Nathan Cowley (not the actual photo)

Some experts don’t recommend starting a marriage in debt

Most couples wish they had enough savings to fund their wedding. But for many, that’s just not the case. As evident from the survey above, newlyweds use everything from credit cards, relatives, and even loans to pay for their dream wedding.

David Bach, the author of Smart Couples Finish Rich, shared a few tips with The Knot on how to save for a wedding and be smart. He doesn’t recommend starting a marriage in debt: “Don’t consider paying for things with money you don’t have and won’t have for a long time,” he says. “Going into marriage with debt for a one-day party is a huge mistake.”

First, he recommends starting to save early. And if the required budget seems too daunting, break up the amount by months. If a wedding costs $60k, that means the couple would need to save $5,000 a month for 12 months to reach their goal. This can also put the wedding budget in perspective: if $5,000 a month seems too much, perhaps the goal sum is just too big.

What are some ways to reach that goal if the couple is determined to save? A portion of the $60k can be covered by parents or relatives. But borrowing money from family can sometimes come with strings attached, so experts recommend it only in cases where there’s a good relationship.

Other ways to save up for the wedding might include:

Image credits: Rene Terp (not the actual photo)

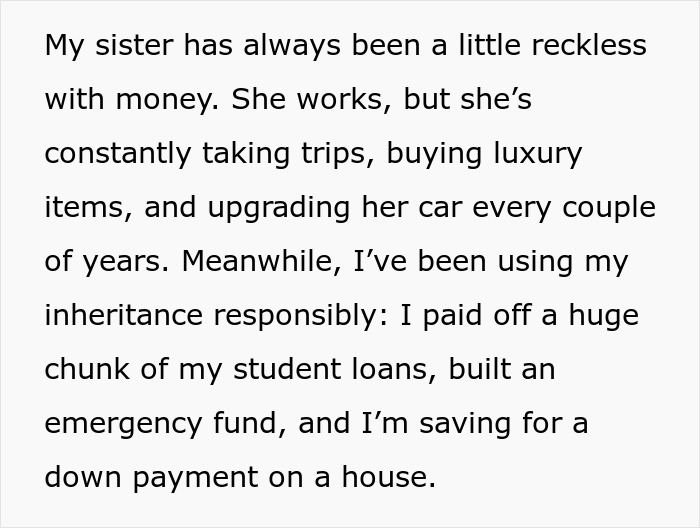

The woman didn’t want to lend the money because of the sister’s poor track record with money

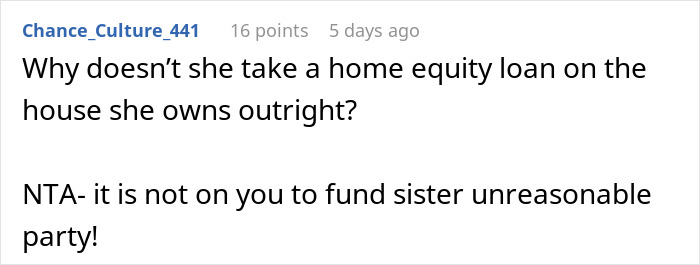

People had little sympathy for the bride and sided with the sister: “You’ll never see that money again”

Follow Us

Follow Us