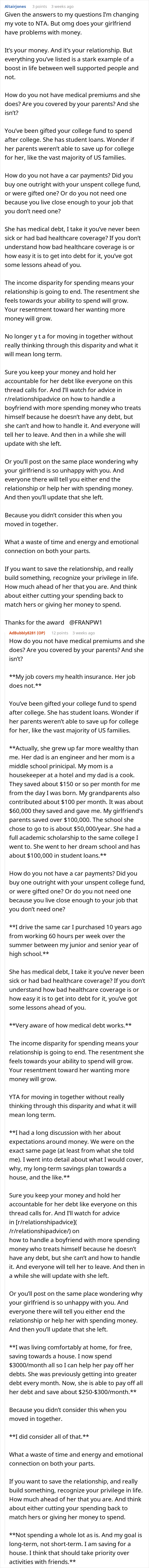

Should couples combine their salaries, have joint bank accounts, or keep their financial affairs completely separate? People have been divided about this for years.

After moving in together recently, one couple agreed to split their joint expenses proportional to their incomes. The guy says he earns a lot more than his girlfriend, so he pays most of the monthly household costs. He’s still left with enough money to save, whereas she isn’t.

Now, she wants them to combine their incomes and split everything down the middle. He’s flat-out refused and is now being called selfish.

He agreed to cover most of their joint expenses because he earns more than her

Image credits: senivpetro (not the actual photo)

Now, she wants some of his savings too and he doesn’t believe she’s entitled to it

Image credits: EyeEm (not the actual photo)

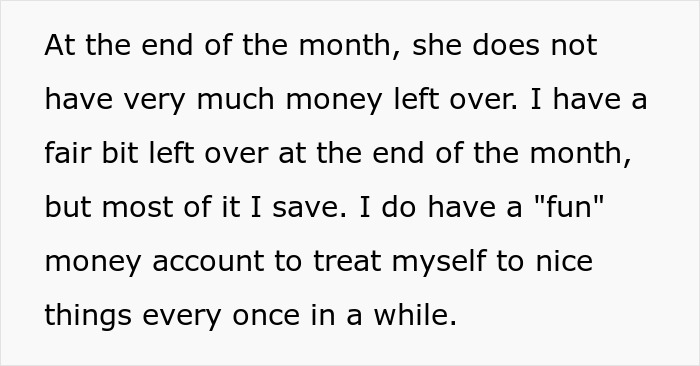

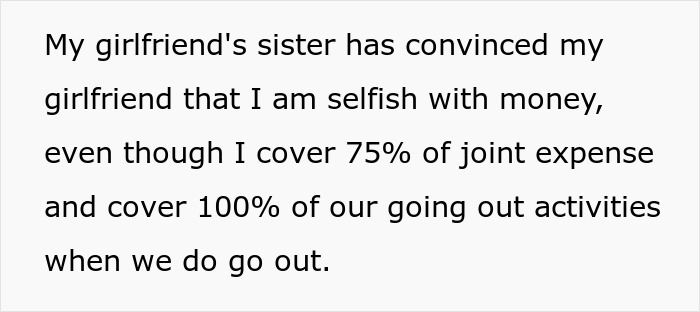

Image credits: AdBubbly8281

The guy provided loads more info when prompted by a few people

Netizens weren’t afraid to say exactly what was on their minds

Image credits: freepik (not the actual photo)

The guy revealed later that things had taken a dramatic turn

Image credits: freepik (not the actual photo)

Image credits: AdBubbly8281

How should unmarried couples handle their finances? Here are three options, according to experts:

There’s no set rule for how couples should handle their money. But experts warn that unmarried partners don’t have the same legal protection as married couples when it comes to finances.

“Marriage provides spouses with access to certain financial benefits that are unavailable to unmarried partners,” notes American consumer credit reporting agency, Equifax. “However, plenty of couples have long, fulfilling relationships without ever tying the knot.”

When it comes to money matters, what works for one couple may not work for another.

“What’s important is that both partners are on the same page and agree on how you should handle finances, including bank accounts, household expenses, and financial goals,” says Adam Kol, founder of The Couples Financial Coach.

According to Kol, there are three options when it comes to deciding how to manage your money as an unmarried couple.

The first is to keep your finances separate. Each partner has their own bank account, credit cards, etc. There is no joint account. “This can get complicated if you live together or have shared expenses because you must determine which partner is responsible for each expense,” warns the expert.

If you’re wanting to go this route, the key lies in communication. Kol advises that you discuss your financial lives, determine who should pay which expenses, and ensure both partners feel the sharing is equal.

“Just because you keep your money separate doesn’t mean you shouldn’t share details or communicate about money, bills, and financial goals,” he adds.

Another option is a joint account where you each deposit money into.

“Some couples choose to open a joint account to cover monthly household expenses but keep their individual checking accounts separate,” notes Equifax. “This can be a great way to handle shared expenses without completely merging your finances.” But this too comes with pros and cons.

“When you have joint bank accounts for unmarried couples, both partners have equal access to the money. This may make it easier to see how much each partner earns and contributes to the household expenses, but be careful,” warns Kol. “Because you aren’t married, there’s nothing in the law stating who gets the money if you separate. While you can close the account at the bank, you must decide how you split the funds between the two of you.”

One way to protect yourself is to draw up a cohabitation agreement that states all assets are properly divided if you go your separate ways.

The final option, says Kol, is to completely combine your finances. It’s also risky because as we said before, unlike with married couples, there’s no built-in legal protection if things go south.

Kol suggests couples only consider completely combining finances after getting engaged or fully committing to one another “so that you know this is a long-term deal.”

“Gold digger”: many applauded the man for standing his ground

Follow Us

Follow Us