Parenting doesn’t come with a manual, especially when your child becomes an adult but still needs guidance. Many parents try to strike a balance between support and independence, hoping their kids will learn to handle money, responsibility, and trust. But sometimes, even the most well-meant plans can unravel in painful and unexpected ways.

That’s what happened to today’s Original Poster (OP) and their spouse, who thought they were teaching their 20-year-old son valuable life lessons about saving and accountability. What began as a simple “fake rent” plan meant to help him build financial stability quickly spiraled into a fractured relationship, a $3,000 credit card bill, and months of silence.

More info: Reddit

Parenting doesn’t end when your child turns 18; rather, it simply changes shape as they enter into the complex decade of their 20s

Image credits: geargodz / Freepik (not the actual photo)

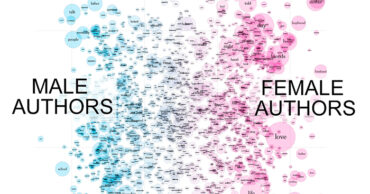

The author and their spouse set a $500/month “rent” planned to help their 20-year-old son save for independence for when he had to move out

Image credits: No-Wonder5226

Image credits: krakenimages.com / Freepik (not the actual photo)

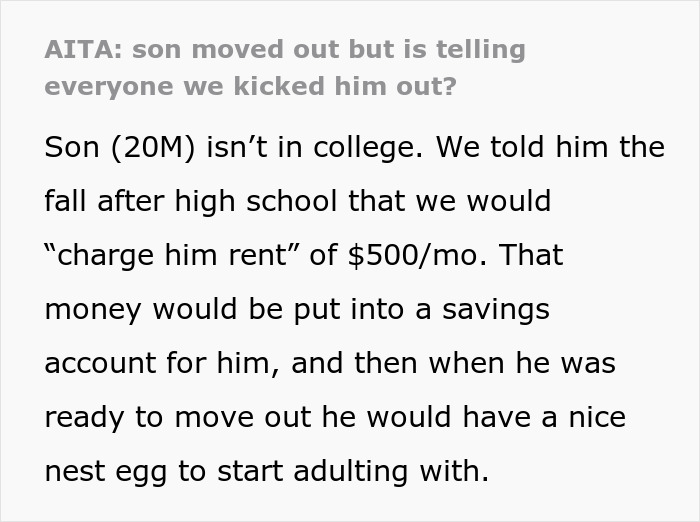

When they were going on vacation, they left him his credit card to use for emergencies, but he used up $3,000 without permission, spending it on clothes and food

Image credits: No-Wonder5226

Image credits: tsyhun / Freepik (not the actual photo)

When they returned, they asked him to repay the money, but he ignored their demands, barely paid rent, and refused to cooperate

Image credits: No-Wonder5226

Image credits: Il Vagabiondo / Unsplash (not the actual photo)

After being given a final deadline to pay back half the stolen money, the son and his girlfriend, who had been living with them, abruptly moved out, leaving minimal contact

Image credits: No-Wonder5226

They then found out that the son had gone around telling people that he was kicked out, which left them wondering if they were too harsh, especially since he refused to speak to them

After their son finished high school, the OP and their spouse had a smart deal in mind. Instead of charging him real rent, they asked for $500 a month with the hopes of tucking it into a savings account as a nest egg for when he finally moved out.

However, the son rarely paid the “rent,” and things got even worse when the couple left him their credit card “for emergencies” when they went on vacation. Instead of a responsible emergency, it turned into a $3,000 spree on food and clothes. Naturally, the OP and their spouse were not thrilled.

They asked their son to pay them back, but months passed and the money never appeared. After some time, they’d had enough and gave him a three-month deadline to return at least half of the money or move out. The deadline came and went, and finally, when the mom asked the son if he was looking for a new apartment, he exploded, yelling that he was moving out.

The next morning, he and his girlfriend were gone without saying a word. After storming out, the son returned once to pick up clothes but didn’t say a word to them. Since then, he’s barely responded to texts. To make things worse, they later discovered he’d been telling people they kicked him out, leaving them wondering if they were too harsh or just doing what any parent would.

Image credits: freepik / Freepik (not the actual photo)

The truth is, many young adults struggle with managing their finances due to several common mistakes. Investopedia highlights major issues like impulsive spending, failing to create or stick to a budget, as well as overspending.

They note that some live beyond their means, not seeking financial education or guidance, which leaves them unable to handle money responsibly and make informed decisions.

Psychology Today would agree that parenting young adults in their 20s comes with unique psychological challenges, as this stage of life is often marked by a stronger desire for autonomy. They explain that in this phase, parents want to avoid overparenting, though still wanting to intervene and support their adult children’s journey toward independence.

However, Serenity Lane insists that this is possible by collaborative goal-setting, encouraging decision-making to help them take ownership of their actions, avoiding immediately fixing problems, and allowing natural consequences to teach responsibility. They also emphasize consistent consequences for actions, and gradually releasing control over time.

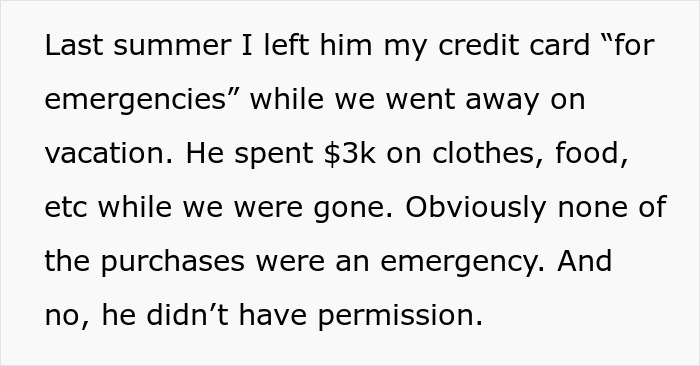

Netizens sided with the OP, emphasizing that the son’s behavior warranted strong boundaries. Many suggested cutting off remaining support and reinforced that the parents were justified. Others highlighted the importance of teaching life lessons, even if it feels harsh, and agreed that the son’s sense of entitlement needed correction.

What do you think about this situation? Do you think the son is entitled, or are the parents too controlling? We would love to know your thoughts!

Netizens insisted that the author and their spouse had acted appropriately and that the focus should remain on guiding their son toward accountability

Follow Us

Follow Us