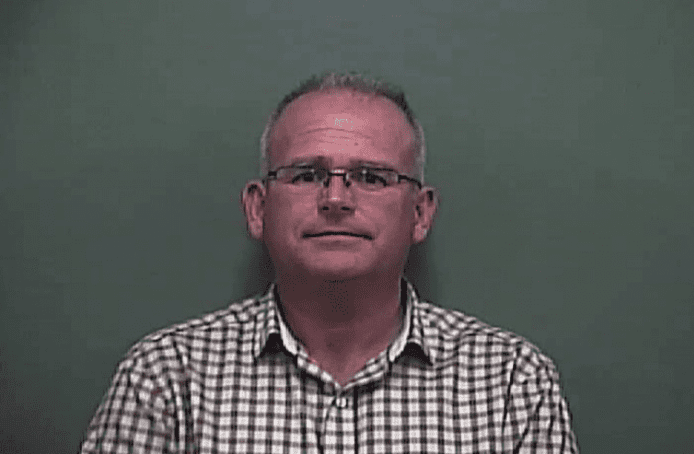

Mitchell Simpson, a former North Georgia used car dealer, has pleaded guilty to wire fraud, defrauding lenders of $3 million. Simpson, 56, operated Mitch Simpson Motors in Cleveland and will be sentenced on October 8. His fraudulent actions, involving deceptive loan practices, were revealed by federal prosecutors, highlighting serious breaches of trust within the automotive financing industry.

Simpson’s scheme involved lying to secure multiple loans on the same vehicle, violating loan agreements, and misleading lenders. Arrested in 2019, Simpson’s actions resulted in significant financial losses for lenders and affected numerous buyers. The case underscores the importance of vigilance and integrity in business operations.

Deceptive Practices and Fraudulent Loans

From early 2012 through early 2019, Simpson operated Mitch Simpson Motors, securing millions in loans from Dealer Financial Holdings LLC, Americash Advance, Inc., and Floorplan Xpress, LLC-OK by providing false information. He repeatedly used the same vehicles as collateral for multiple loans, violating the terms of his loan agreements. Prosecutors revealed that Simpson made false and misleading statements to hide this double and triple floor-planning, which was illegal under the financing agreements.

Out of Trust Operations

Simpson’s fraudulent activities included not promptly repaying lenders, hiding vehicle titles, and not disclosing the true status of the cars. These deceptive actions led to significant financial losses for the lending companies, amounting to over $3 million. The U.S. Attorney’s Office highlighted that Simpson operated ‘out of trust’ by not repaying the loans as required, further complicating the lenders’ ability to reclaim their funds.

Arrest and Legal Proceedings

Authorities arrested Simpson in 2019 following an investigation by the FBI. Senior Supervisory Special Agent Mitchell Jackson emphasized the FBI’s commitment to holding fraudulent individuals accountable, highlighting Simpson’s betrayal of lender trust. The FBI’s investigation uncovered that Simpson played a shell game with vehicle titles and consistently provided false information about vehicle locations and whether they had been sold.

Community Impact and Unresolved Sales

Nearly 60 buyers reported issues with unpaid taxes and undelivered titles after purchasing vehicles from Mitch Simpson Motors. Despite efforts to contact Simpson, many turned to local news channels for help, revealing the broader impact of his fraudulent practices on the community. Buyers expressed frustration and financial loss, as they were left without proper documentation for their purchased vehicles.

Sentencing and Future Implications

Simpson’s sentencing is scheduled for October 8 before U.S. District Judge Steve C. Jones in Gainesville. The case serves as a cautionary tale for both lenders and consumers about the risks of fraudulent activities in the automotive sector and the importance of due diligence. Authorities hope that this conviction will deter similar fraudulent schemes and reinforce the need for transparency and honesty in business dealings. The legal proceedings against Simpson also underscore the critical role of regulatory oversight in protecting the integrity of financial transactions within the automotive industry.

Follow Us

Follow Us