Money both solves and creates problems, and Reddit user Sea_Golf_3839 is experiencing this firsthand. The man claims he and his fiancée had worked out an arrangement that — they believed — would be fair for their kids. He parents his, she takes care of hers, and everyone is happy. Well, after seeing the way he treats his son and daughter, his fiancée’s children told her they want him to become their stepdad. But he suspects ulterior motives and refuses to agree, creating tension in the household.

Boundaries are supposed to help people and their relationships

Image credits: Prostock-studio / Envato (not the actual photo)

But if they’ve grown into walls, it can be hard to dismantle them

Image credits: svitlanah / Envato (not the actual photo)

Image credits: valeriygoncharukphoto / Envato (not the actual photo)

Image credits: Sea_Golf_3839

Couples fight a lot about money

Image credits: chartchaik1 / Envato (not the actual photo)

A recent survey of 2,000 Americans in a relationship discovered that of those uncomfortable speaking with their significant others about money, almost half (44%) worry that discussing finances in their relationship will lead to disagreements, which is precisely what has happened to our Redditor.

This is understandable, as the average couple in the survey reported having 58 money-related arguments per year.

The research, conducted by Talker Research on behalf of international money app Wise, revealed that younger couples are more likely to have disagreements about money — with Millennials reporting about six arguments per month, compared to Baby Boomers’ three.

Across all respondents, arguments are most likely to focus on what’s considered a necessity to spend on each month (43%) and how much to spend on non-essentials, such as streaming subscriptions and vacations (36%), as well as how much money should be saved (34%).

However, the potential of starting arguments wasn’t the only reason why respondents said they feel uncomfortable speaking with their partner about finances. For these respondents, almost a third said these conversations are difficult because they have different ideas about how much to spend and save (32%), while a quarter (26%) feel their partner isn’t as responsible with money as they are.

Blended families often have it even worse

According to an older survey sponsored by financial services company Allianz Life, blended families have far less savings and are significantly more likely to live paycheck-to-paycheck than traditional families.

One-third of blended families report they’re not saving at all. And they’re twice as likely to report that their spouse brought financial baggage into the relationship that’s tough to overcome.

“The defining characteristic of blended families is the financial baggage and commitments that they bring from their previous relationships,” said Allianz vice president Katie Libbe. The survey found:

Live paycheck-to-paycheck

On track to reach financial goals

Conflicting priorities between partners

Spouse brought economic baggage that’s tough to overcome

If there’s a bright side, it’s that the economic struggles of blended families make them more likely to teach their kids about money than a traditional family (74% vs 69%).

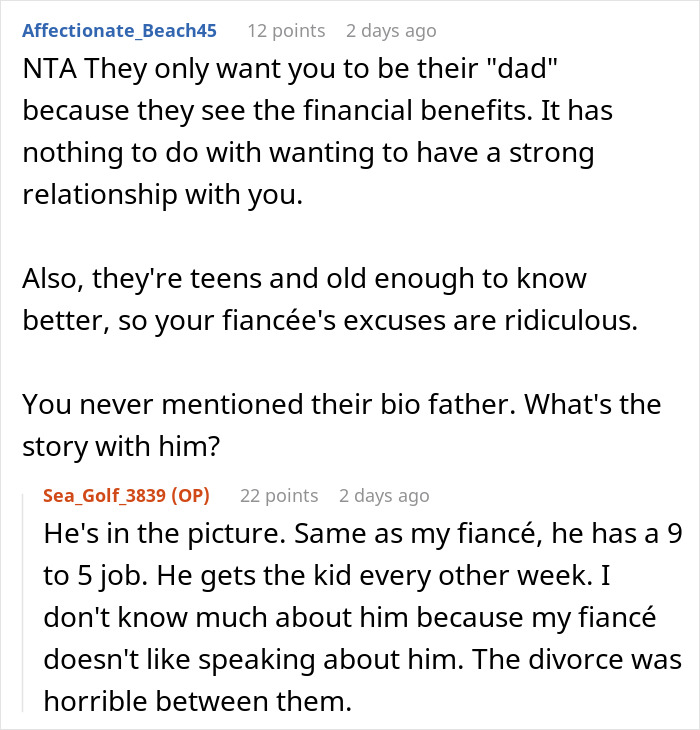

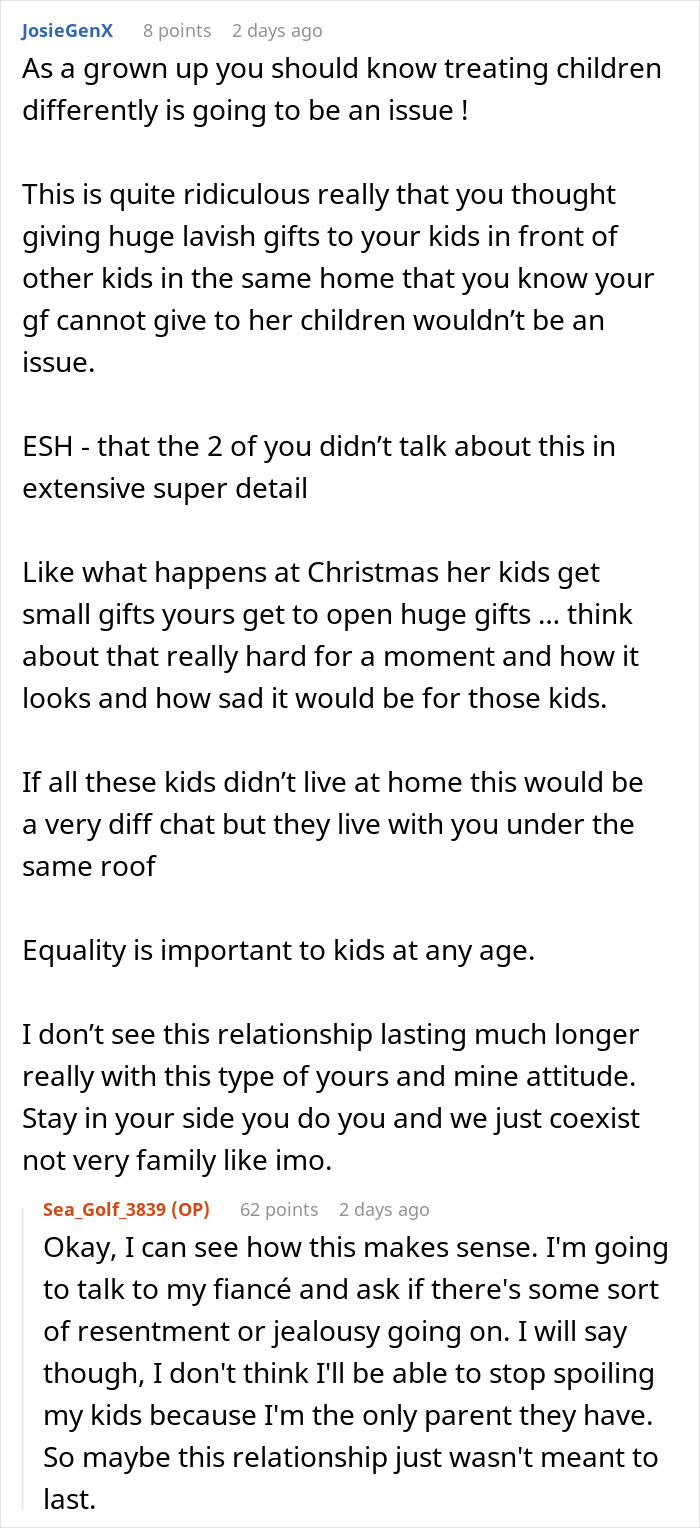

As his story went viral, the man provided more information about his family

A lot of people who read about their arrangement thought it was weird

Still, some believe he has every right to refuse to parent his fiancée’s kids

A few, however, said he should show more empathy if he intends to actually marry this woman

Follow Us

Follow Us