Money has a way of complicating even the healthiest relationships, especially when major life changes happen unexpectedly. For example, situations where one partner gains financial stability while the other does not, questions about fairness, security, and trust can surface in uncomfortable ways.

That tension sits at the center of this story, where today’s Original Poster’s (OP) inheritance gave her long-term housing security. All of a sudden, what began as a practical decision to live together slowly turned into a difficult conversation that left her questioning their relationship.

More info: Reddit

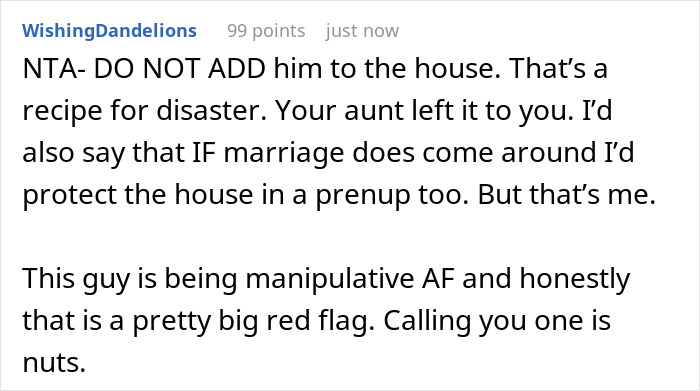

In romantic relationships, love and trust are meant to be the glue that holds two people together, not a free pass to claim someone else’s hard-earned asset

Image credits: Stockbusters / Freepik (not the actual photo)

The author inherited a small townhouse from her aunt and used her savings to make essential repairs, gaining long-term housing stability

Image credits: jcomp / Freepik (not the actual photo)

Her boyfriend moved in when his lease ended, contributing a set amount toward utilities and minor expenses, while she continued to cover major costs

Image credits: Wavebreak Media / Freepik (not the actual photo)

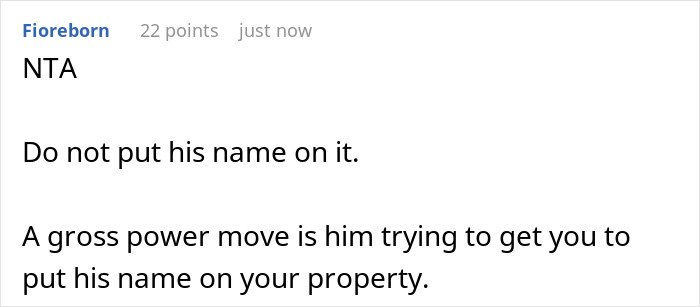

After a while, he began expressing concerns about fairness, feeling insecure that he wasn’t building equity and eventually asked to be added to the deed

Image credits: 3vening_Switch

She refused, offering alternative solutions like cohabitation agreements or shared savings, but he rejected them and turned cold after another firm refusal

After losing her aunt, the OP inherited a small but life-changing townhouse. It wasn’t glamorous, but it freed her from the endless cycle of rent and eating into her savings. Like many inherited properties, it also came with hidden costs from repairs and safety fixes which she covered herself.

When her boyfriend’s lease ended, moving in together felt like the natural next step. They shared daily expenses, and he paid her a reduced monthly amount that helped offset ownership costs. It was cheaper than his previous rent and also helped keep the house running.

Over time, her boyfriend started to mention that he was uncomfortable that only she was building equity. He worried that if the relationship ended, he’d walk away with nothing to show for it. The OP tried to address this practically, suggesting legal agreements and shared savings plans, but he rejected those ideas saying that they were partners, not roommates.

Then one day, her boyfriend pointedly asked to be added to the deed. For her, this felt like transferring half ownership of an inherited asset without marriage or shared debt responsibility. However, he insisted that if he really saw a future with him, then they should own things together. When she refused, he accused her of “holding power” and turned cold towards her.

Image credits: freepik / Freepik (not the actual photo)

Taken together, these findings help explain why situations like the one in this story are becoming increasingly common and complicated. The U.S. Census Bureau highlights that more couples than ever are choosing to live together without marriage, reshaping how they approach shared finances, housing, and long-term security.

While cohabitation is now widely accepted and often practical, many couples still navigate major financial decisions without the legal protections marriage automatically provides. This is where legal and financial planning becomes critical. Waely Law explains that unmarried couples who share a home are often advised to use tools like cohabitation agreements, powers of attorney, and structured joint savings plans.

These measures help clarify expectations, define responsibility, and protect both partners if circumstances change. Legal experts cited by Nolo further caution that adding an unmarried partner to a property deed without proper safeguards can create serious long-term risks. These include loss of control over the home and potential exposure to a partner’s existing debts or creditors.

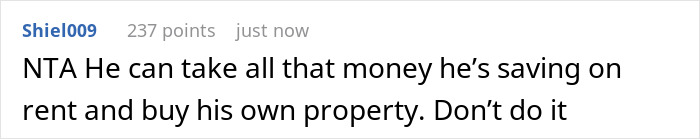

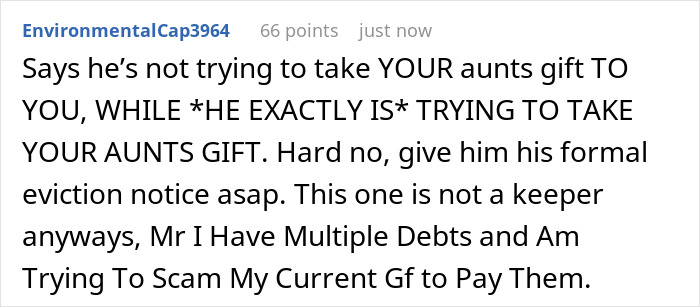

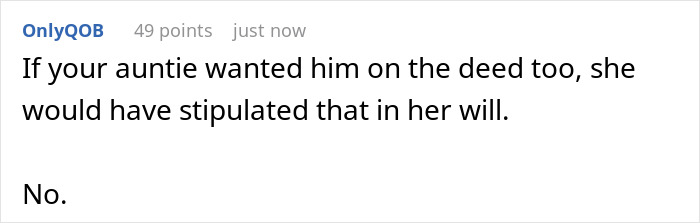

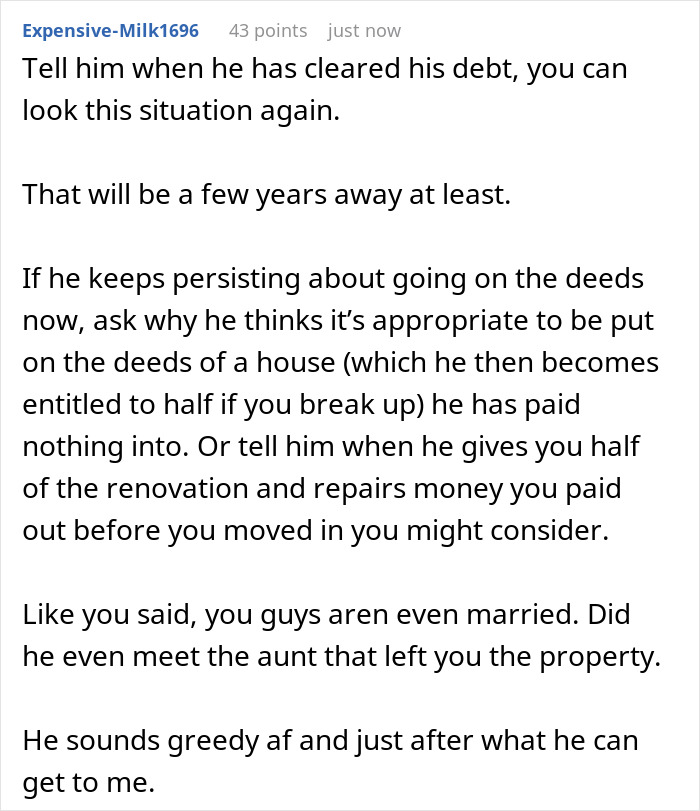

Netizens urged the OP not to add her boyfriend to the deed, warning that doing so could put her inheritance and financial future at serious risk. They also described her boyfriend’s actions as manipulative and entitlement-driven rather than rooted in genuine insecurity. If you were in the OP’s position, how would you handle a partner who keeps pushing this issue? We would love to know your thoughts!

Netizens pointed out that the home was a gift from the author’s aunt and that adding him would immediately give him access to something he didn’t earn or contribute to upfront

Follow Us

Follow Us