Activist investor Nelson Peltz has sold his entire Disney (DIS) stake, according to a source familiar with the matter. This move follows a highly contested proxy battle where Disney managed to fend off Peltz’s efforts to secure board seats at the entertainment giant.

Peltz divested his position at approximately $120 per share, yielding a return of about $1 billion, disclosed the insider. The sale, first reported by CNBC, comes just weeks after the shareholder meeting in early April where Disney’s board emerged victorious by a substantial margin

.

A Resolute Battle for Board Seats

Peltz had been aggressively pursuing board seats for himself and former Disney CFO Jay Rasulo. However, Disney shareholders ultimately voted to keep the current board unchanged. During the campaign, Peltz expressed dissatisfaction with Disney’s performance despite their eventual win.

Trian Fund Management’s Stakes and Moves

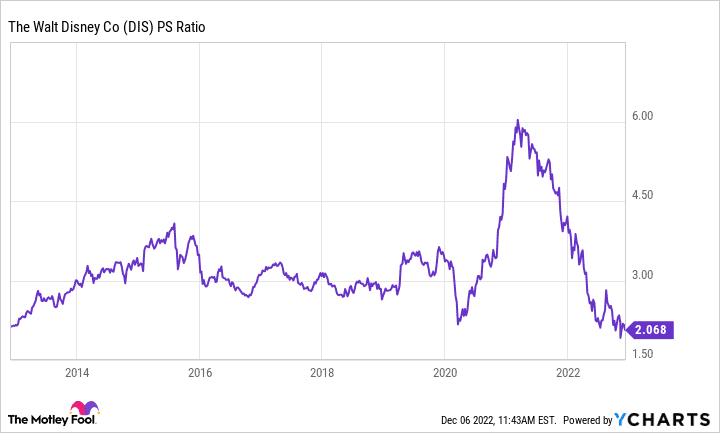

Peltz’s hedge fund, Trian Fund Management, was a significant stakeholder in Disney, holding $3 billion in common stock. This included shares owned by former Marvel Entertainment chair Ike Perlmutter. Peltz renewed his push for board changes last year amid Disney’s plunging stock prices.

The Financial Aftermath

Disney shares have seen about a 12% increase since the start of the year but have plummeted roughly 15% since prevailing against Peltz in the proxy fight. The current share price stands at $103.91, with notable fluctuations in recent months.

Over the past year, DIS underperformed the US market, which returned 22.2%. A detailed breakdown shows a 52-week high of $123.74 and a low of $78.73, reflecting an overall volatile trend.

Peltz’s Stance and Future Actions

Nelson Peltz continues to be a noteworthy figure not just in investment circles but also politically, as he favors Donald Trump in the upcoming election. Given this development and his public persona, his future investment strategies are keenly observed.

His presence at prominent events, such as speaking at the WSJD Live conference in Laguna Beach on October 25, 2016, highlights his influential role in finance.

As investors and market watchers reflect on this major shift, it will be interesting to see how it influences Disney’s policies and strategies moving forward.

Follow Us

Follow Us