They say money makes the word go round, but in families, it just makes everything spin out of control. Seriously, nothing stirs up tension faster than cold, hard cash. You could be the most generous person on the planet, but the second relatives get a whiff of your juicy bank balance, suddenly you’re an interest-free loan provider with zero repayment terms.

One Redditor financed his in-laws for years, giving them money every time they asked for it, but finally decided to put an end to it when he found out they married off their teen daughter to a sugar grandpa.

More info: Reddit

Mixing family and money is like sharing a Netflix password; no big deal at first, but suddenly, everyone’s using it, and you’re the one paying

One man cuts off financial support to his in-laws and stops paying for his mother-in-law’s medication, after years of giving them money they spent on alcohol and gambling

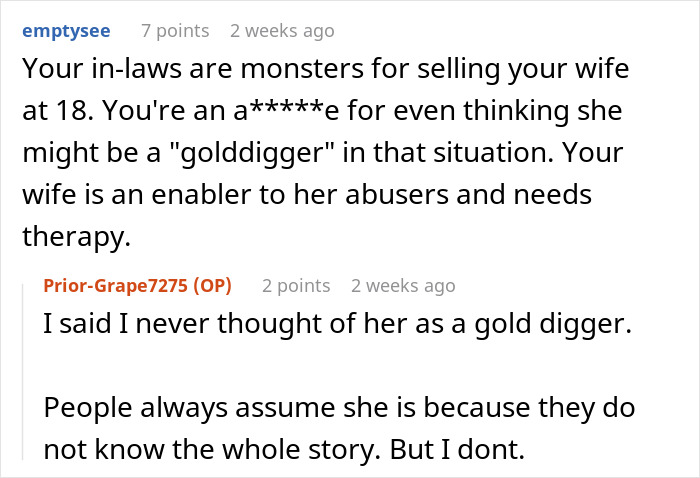

The man finds out his wife was forced to get married to a much older, rich man at 18, so her parents could pay off their debts

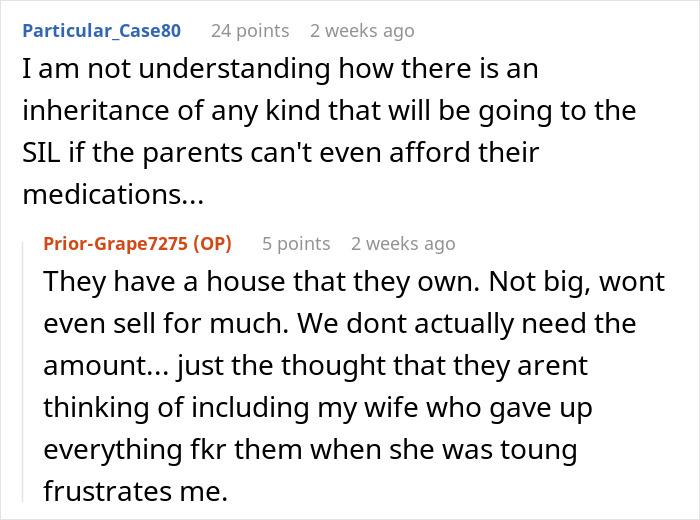

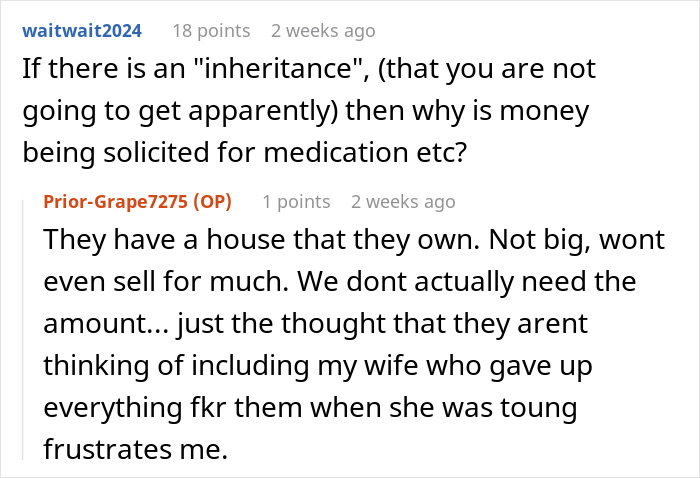

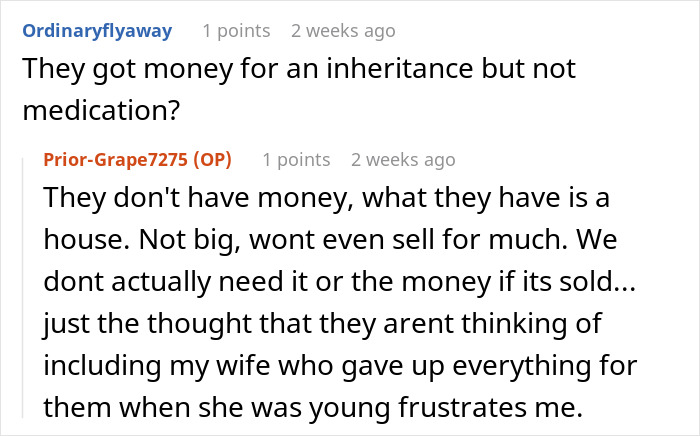

The wife’s parents keep asking for money from the man, blowing the emergency fund he created for them, but plan on leaving the entire inheritance to her sister

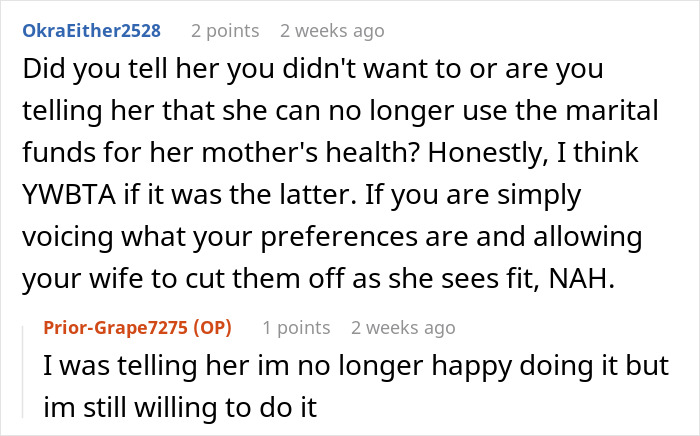

The man feels like his in-laws are taking advantage of him, refuses to finance them anymore, and stops paying for his mother-in-law’s medication

The OP (original poster), has been covering his mother-in-law’s medication costs for over 5 years, but after stumbling upon some next-level family secrets, he decided it was time to retire from his role as the unofficial family ATM. And let’s just say, his wife was not thrilled. But can you blame the guy? The list of financial betrayals is longer than your first day back at work after a vacation.

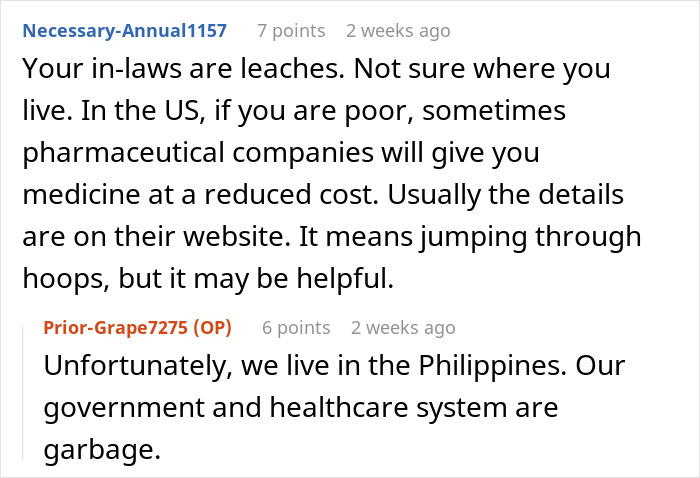

First up on the Hall of Fame is the arranged marriage. Our OP found out his wife married a much older man at 18 so her parents could clear their debts. Not exactly a fairytale romance, right? Then there’s the sister-in-law, who borrowed a fat stack of cash to fix her roof, but instead of actually fixing it, she decided to invest in her true passions: alcohol and gambling. I guess a leaky roof doesn’t beat a dry martini.

And the cherry on this financial disaster sundae? The OP’s wife has spent years supporting her parents, but when it comes to inheritance time, everything is going to her sister. Yep, no thank-you, no reimbursement. Nothing. And let’s not forget about the “emergency fund” the OP set up for his in-laws. But instead of saving it for actual emergencies, they drained it faster than a teenager’s phone battery on TikTok.

After all of this, our guy decided he was done. No more footing the bill for his mother-in-law’s medication. But when he finally put his foot down, his wife was devastated, arguing that this was about her mother’s health. Now, he’s stuck wondering: is he heartless, or just finally enforcing some much-needed boundaries? Because, let’s be honest, nobody wants to feel like they’re just an ATM for their family.

You know, there’s a fine line between being generous and being a human cash machine that never runs out of bills. Some people see kindness as an open invitation to keep taking, especially if they know you’ll cave under the pressure. When someone constantly asks you for money or favors and expects you to take care of their needs but is not there when you need them, those are clear signs that those people are using you.

The pros say the trick is recognizing when generosity turns into obligation, and setting boundaries before your bank account starts sobbing for mercy. Make it clear what you can and can’t do, and most importantly—don’t feel guilty for saying no. If you wouldn’t finance a random stranger’s bad decisions, why should you bankroll a relative’s?

I get it, helping out your family feels like the right thing to do, but that doesn’t mean you have to allow anyone to take advantage of your kindness, especially when it comes to finances. Money is the number one reason couples fight, and, yes, it’s one of the leading causes of divorce. Why? Because when one person is saving for retirement while the other is secretly funding their family’s financial crises, resentment builds fast.

The key to avoiding heated arguments about financial disagreements? Transparency, teamwork, and a whole lot of “we need to talk about this.” Set clear boundaries on what’s ours versus what’s theirs, agree on non-negotiables, and most importantly, make sure you’re both on the same page before making financial commitments that could sink your future. Because nothing says “happily ever after” like not going broke together.

So, what do you think? Should the poster stick to his decision and finally cut off the family money pit, or does he owe his mother-in-law this one last act of support? Drop your thoughts below!

Netizens side with the man, saying he is not a jerk for refusing to give money to his wife’s parents anymore

Follow Us

Follow Us